ESG reporting refers to the disclosure and communication of a company's performance and practices in the areas of Environmental, Social, and Governance (ESG) factors. This type of reporting is a way for companies to provide transparent and comprehensive information about their impact on the environment, their relationships with various stakeholders, and the governance structures in place. ESG reporting has become vital and mandatory as investors, customers, employees, and other stakeholders seek to understand and assess a company's sustainability and ethical practices.

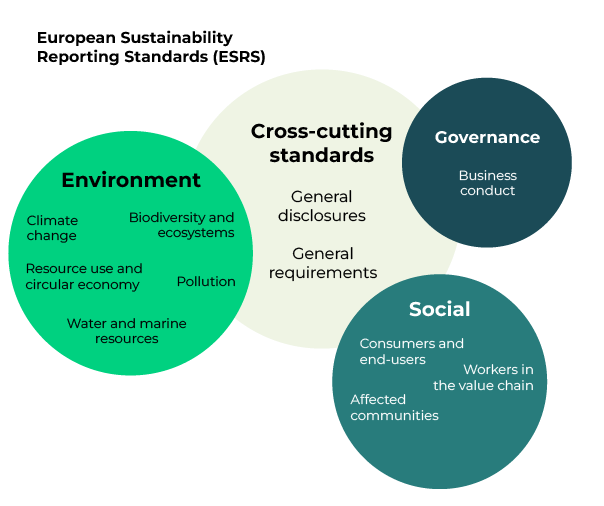

The existing Corporate Sustainability Directive (CSRD) standardizes and defines sustainable development reporting. European Sustainability Reporting Standards (ESRS) have been created to support this directive, which defines four different areas and the sustainability matters to be reported within them.

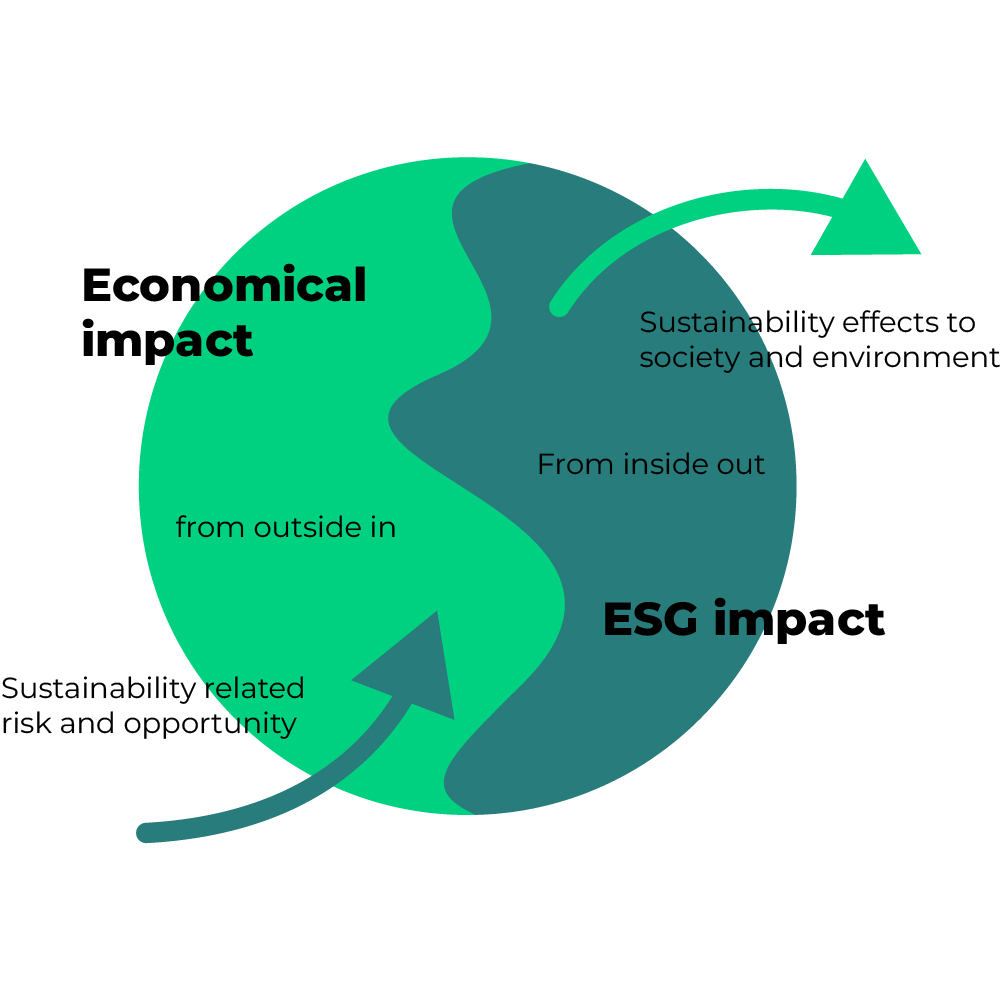

CSRD directive also includes double materiality assessment, which extends reporting responsibility to the value chain including up and down streams. It requires that companies meeting certain criteria must add a non-financial statement to their management report. The reporting obligation covers not only financial performance risks that affect sustainability, but also risks that affect people and the environment.

The Voluntary Sustainability Reporting Standard for non-listed SMEs (VSME) from EFRAG offers SMEs a simplified and flexible way to report on their sustainability without undue bureaucracy and is aligned with ESRS standards.

The most central principles of sustainability reporting and corporate responsibility is the materiality and its definition. In the new directive, the principle of double materiality guides the materiality assessment. With the help of double materiality, it is possible to determine the themes of sustainability that are essential for the company, i.e. in practice also what topics are communicated in the sustainability reporting.

Understanding the double materiality is essential when preparing a sustainability report, but it can also be used to understand the company's risk management and sustainability assessment. Analyzing the double materiality can spark new ideas for ideating future business opportunities.

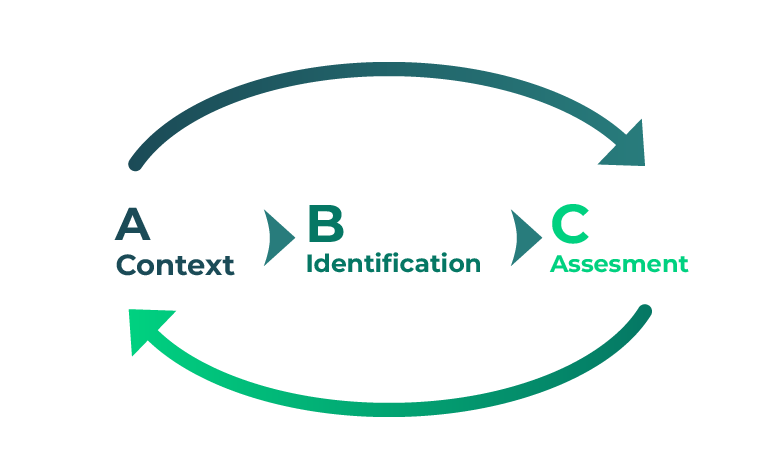

The basis of materiality analysis is to understand what are the company's effects (positive and negative) on people, the environment and society. In order to assess the effects, the company's entire value chain and its business model and strategy must be examined.

Define what materiality means for your organization and be clear about your objectives and audience .

Explore each material topic in detail to understand its relevance to the business and stakeholders.

Apply the criteria for severity to the list of impacts defined in step B above.